25+ weekly mortgage payments

Web Lets look at an example of a do-it-yourself biweekly mortgage. That means your mortgage payments would be 2661 per month.

Buy Simple Everyday Finance Stickers Digital Planning Labels Online In India Etsy

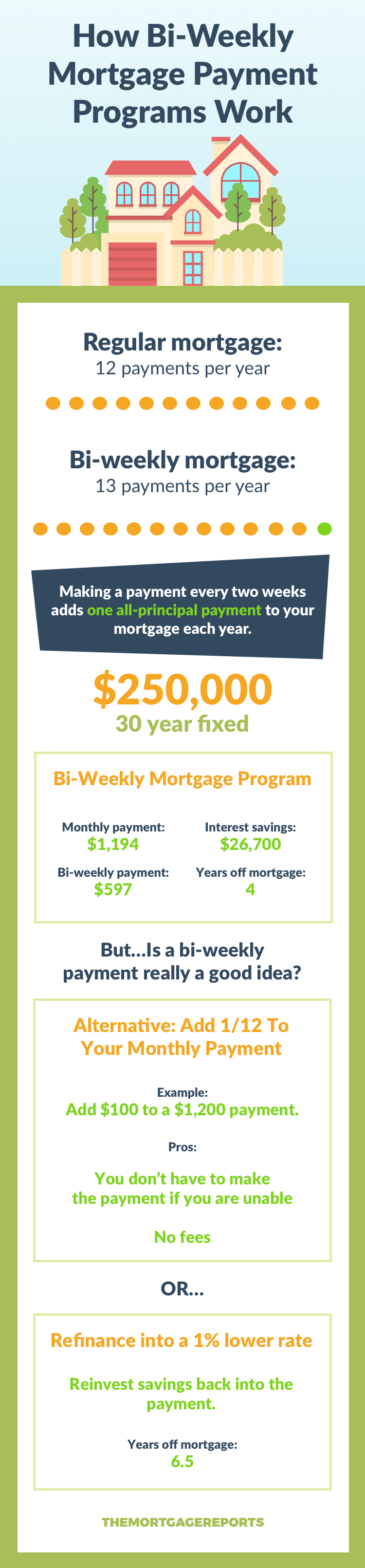

Instead of paying once a month you pay half your monthly mortgage amount every other week.

. 98388 112 of that amount. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Mortgage Loan The charging of real property by a debtor to a creditor as security for a debt.

Over the 5-year term you will. Youll get a low rate custom terms and a fast closing. Web With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year.

The real magic of the biweekly payment comes from the fact that there are 52 weeks in a year giving you 26 total payments. Web Biweekly mortgage payments are a way to schedule your payments to happen every two weeks instead of once a month. Web With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

Web Web Over a single year your monthly payments will total 1718700 143225 x 12 while your biweekly payments will total 1861912 71612 x 26. When you make biweekly payments you could save more money on interest and pay your mortgage down faster than you would by making payments once a month. Web Mortgage Summary Over the 25-year amortization period you will.

Use the calculator to. Web A mortgage payment is calculated using principal interest taxes and insurance. Earlier Your Custom Mortgage is Here Let a salary-based mortgage consultant design the perfect loan for your needs.

Web Generally speaking the premise of making biweekly mortgage payments is simple. Doing some quick math here that means youre signing on for 26 half-size payments a year which is like 13 full-size payments. If you make biweekly payments for the life of the loan once your mortgage is paid off youll have paid a total of 256288 on the loan and youll pay off your mortgage in 25 years and nine months cutting 4 years and 3 months of payments off.

A 150000 mortgage with a 25-year term would cost you 500 on an interest-only basis compared with 792. Weekly payment Monthly payment x 14 52. 30205 in interest Mortgage term.

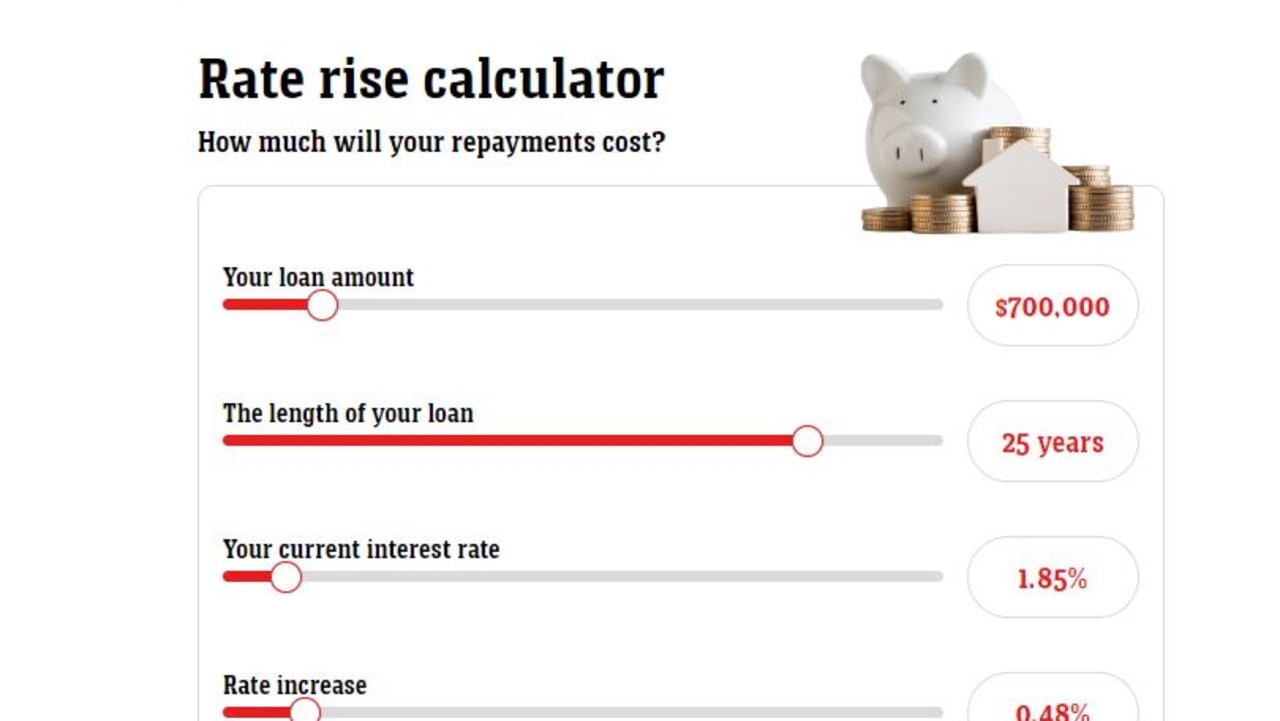

Web 11 hours agoInterest rate rises have left homeowners facing painful rises in monthly payments. 8199 New combined payment paid just once a month. Web Biweekly mortgage payments are a good idea under the right circumstances.

Have made 60 monthly 12x per year payments of 58160. Bi-Weekly Payments Payments that occur once every two weeks. Web Check out the webs best free mortgage calculator to save money on your home loan today.

425 30-year fixed Regular monthly mortgage payment. It is easier for them to form a habit of taking a portion from each paycheck to make mortgage payments. Web The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment including principal and interest taxes and insurance.

Web In other words your weekly mortgage payments would be calculated as follows. Lets say you got a 400000 mortgage with a 7 interest rate and 30-year repayment terms. The limit is as follows for 2 3 and 4-unit homes 929850 1123900 and 1396800.

The above formula is the one used by the weekly mortgage payment calculator on this page which results in making the equivalent of 14 monthly payments per year. Pay Off Your Mortgage Faster. Web Thats a gross monthly income of 5000 a month.

Have made 300 monthly 12x per year payments of 58160. Web Bankrates mortgage calculator gives you a monthly payment estimate after you input the home price your down payment the interest rate and length of the loan term. They can save you thousands of dollars in interest and help you pay off your mortgage faster.

Web 1 day agoFor a 30-year fixed-rate mortgage the average rate youll pay is 694 which is a decline of 2 basis points as of seven days ago. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including principal interest.

Web Bi-Weekly Mortgage Payment Calculator Terms Definitions. Web The bi-weekly payment calculator will help you to calculate the amount of money that you will save by paying your mortgage on a bi-weekly basis instead of a monthly basis. Web With this payment method you pay 382 half your monthly payment every two weeks.

A basis point is equivalent to 001 Thirty-year fixed. Web Biweekly mortgage payments There is an alternative to monthly payments making half your monthly payment every two weeks. Have paid 10000000 in principal 7448150 in interest for a total of 17448150.

Web Standard Payment 1454 mo Payment with Additional Principal 1609 mo Total Savings 43174 Payoff Schedule 5 yrs and 1 mos. Principal Amount The total amount borrowed from the lender. This results in a significant shortening of the period to payoff.

Web Since there are 26 biweekly periods in a year the biweekly produces the equivalent of one extra monthly payment every year. 309 months loan paid off more than 4 years. Web Conforming Mortgage Limits As of 2023 the FHFA set the conforming loan limit for single unit homes across the continental United States to 726200 with a ceiling of 150 that amount in areas where median home values are higher.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. If you want to find out how much your monthly payment will be there are several good online mortgage calculators.

Web Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments including the mortgage car payments student loans minimum credit card payments and child. Web Biweekly mortgage payment example. It can be a good option for those wanting to contribute more money toward a mortgage without having.

This method is mainly for those who receive their paycheck biweekly. Interest The percentage rate charged for borrowing money.

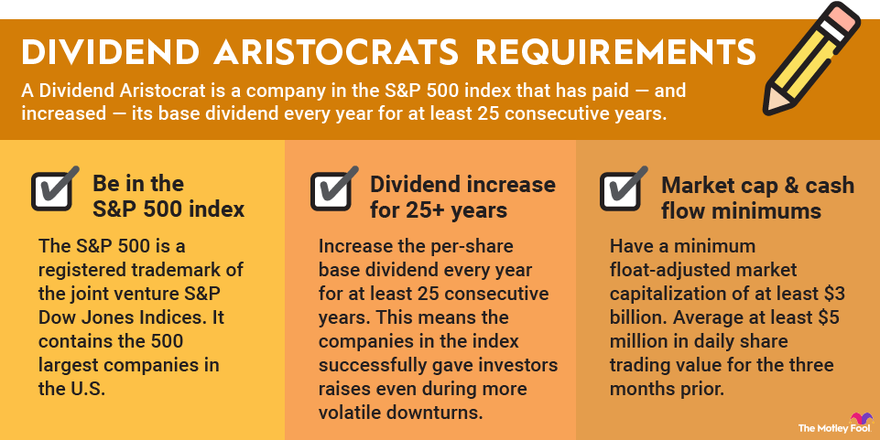

List Of Dividend Aristocrats S P 500 Stocks Included The Motley Fool

Mortgage Due Dates 101 Is There Really A Grace Period

Lot 25 Brann Mills Road Starks Me

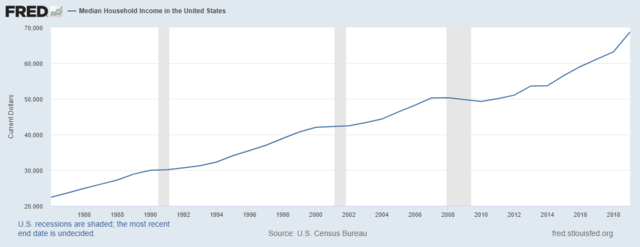

Household Income In The United States Wikipedia

Over 25 Free Printable Cash Envelope Templates The Incremental Mama

Myprimehomeloan Com Mortgage Lender

In An Amortized Mortgage What Portion Of Each Payment Goes Towards Principal And What Portion Goes Towards Interest Quora

Doxo Online Bill Pay Can Be A Hassle You Re Stuck Facebook

How To Calculate Gross Income Per Month The Motley Fool

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

Rba Interest Rates Rise To 1 85 How Much Your Mortgage Will Go Up News Com Au Australia S Leading News Site

25th May Build Upon Presentation

How Much Does A Principal Reduce Each Payment On A Mortgage Quora

Bi Weekly Mortgage Program Are They Even Worth It

Nov 25 Pennywise Kootenay Lake

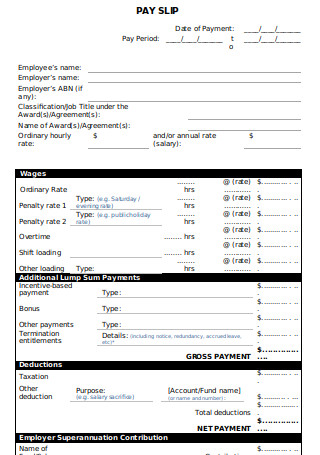

25 Sample Payroll Slip Templates In Pdf Ms Word